中国农业科技导报 ›› 2025, Vol. 27 ›› Issue (5): 1-12.DOI: 10.13304/j.nykjdb.2025.0007

• 农业创新论坛 • 下一篇

张鸾1,2( ), 尹国栋1,2, 张昀3, 姜常宜1,2, 麻吉亮4, 张蕙杰1(

), 尹国栋1,2, 张昀3, 姜常宜1,2, 麻吉亮4, 张蕙杰1( )

)

收稿日期:2025-01-06

接受日期:2025-02-26

出版日期:2025-05-15

发布日期:2025-05-20

通讯作者:

张蕙杰

作者简介:张鸾 E-mail:821012401503@caas.cn;

基金资助:

Luan ZHANG1,2( ), Guodong YIN1,2, Yun ZHANG3, Changyi JIANG1,2, Jiliang MA4, Huijie ZHANG1(

), Guodong YIN1,2, Yun ZHANG3, Changyi JIANG1,2, Jiliang MA4, Huijie ZHANG1( )

)

Received:2025-01-06

Accepted:2025-02-26

Online:2025-05-15

Published:2025-05-20

Contact:

Huijie ZHANG

摘要:

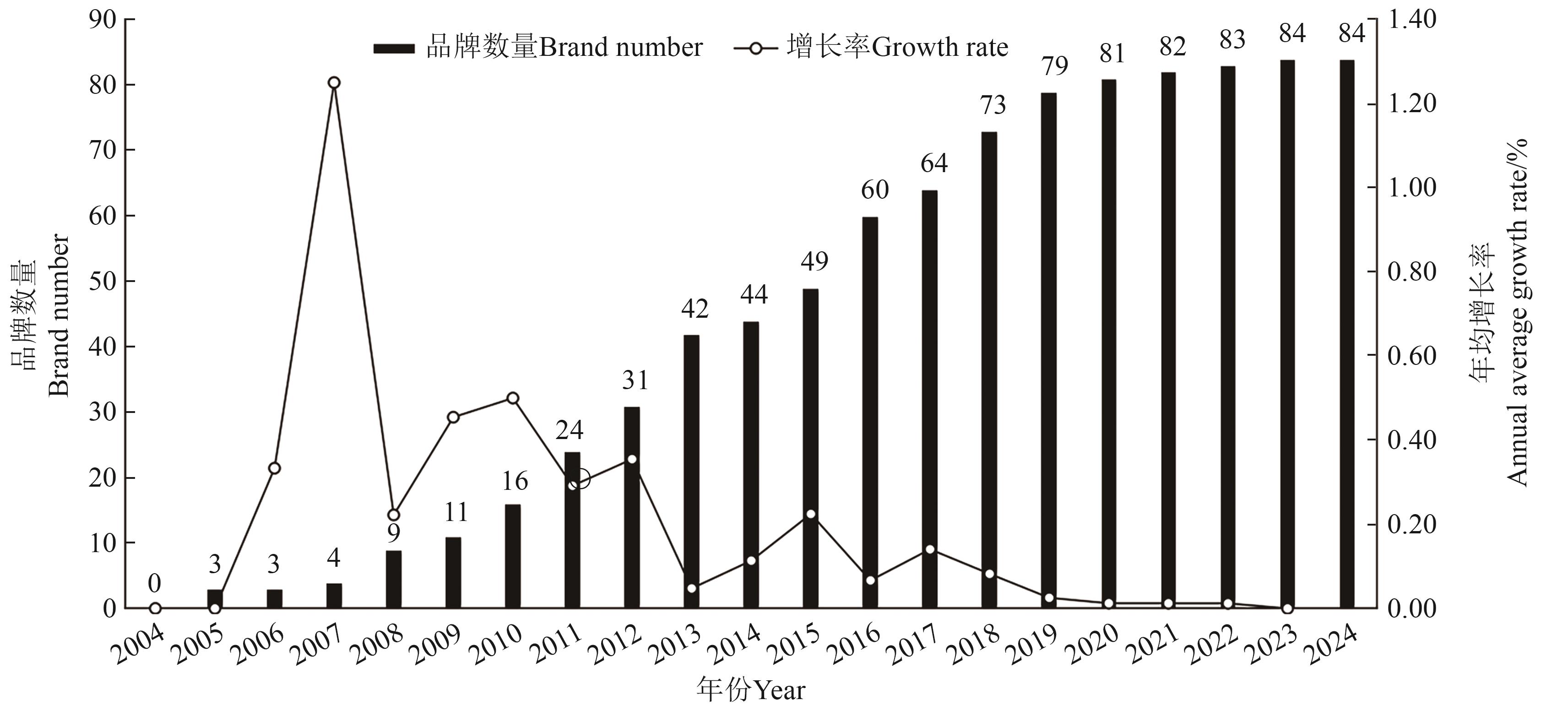

食用豆是中国粮食系统的重要组成部分,区域公用品牌是促进其产业高质量发展的重要抓手。从品牌数量、品牌分布、品牌价值、品牌溢价4个维度分析了食用豆区域公用品牌发展现状。我国已创建84个食用豆区域公用品牌,但年均增长率降至1.2%;1/3种植食用豆的省拥有3/4品牌,9成品牌分布在绿豆、小豆、蚕豆、豌豆、芸豆主栽豆种当中;与其他农产品相比,食用豆区域公用品牌价值为中下游水平,品牌溢价率达到12.63%~2 058.70%。针对食用豆品牌发展存在的顶层设计缺失、发展不充分、药用价值挖掘不够深入和准入退出机制不完善等问题提出了开发创新产品、强化顶层设计、分类培育区域公用品牌、完善品牌准入退出机制的建议。

中图分类号:

张鸾, 尹国栋, 张昀, 姜常宜, 麻吉亮, 张蕙杰. 我国食用豆区域公用品牌发展现状、问题及对策分析[J]. 中国农业科技导报, 2025, 27(5): 1-12.

Luan ZHANG, Guodong YIN, Yun ZHANG, Changyi JIANG, Jiliang MA, Huijie ZHANG. Food Legumes of Regional Public Brands: Status, Problems and Development Suggestions[J]. Journal of Agricultural Science and Technology, 2025, 27(5): 1-12.

图1 中国食用豆区域公用品牌数量数据来源:农业农村部和国家知识产权局。

Fig. 1 Number of regional public brands in China's food legumesData source:Ministry of Agriculture and Rural Affairs and China National Intellectual Property Administration.

省(自治区、直辖市) Province(autonomous region, municipality) | 种植面积 Planting area/hm2 | 面积排名 Area ranking | 品牌 Brand | 品牌数量 Brands quantity | 品牌数量排名 Ranking of brand quantity |

|---|---|---|---|---|---|

云南 Yunnan | 328 000 | 1 | 保山透心绿蚕豆、姚安豌豆 Baoshan Touxin green bread beans, Yao’an peas | 2 | 10 |

四川 Sichuan | 171 000 | 2 | 海棠大白芸豆 Haitang large white kidney beans | 1 | 15 |

贵州 Guizhou | 130 900 | 3 | 威宁芸豆、桐梓团芸豆、龙里豌豆尖 Weining kidney beans, Tongzi tuan kidney beans, Longli peatip | 3 | 8 |

重庆 Chongqing | 104 970 | 4 | — | 0 | — |

甘肃 Gansu | 94 630 | 5 | 会宁扁豆 Huining Lentils | 1 | 15 |

内蒙古 Inner Mongolia | 84 140 | 6 | 天山大明绿豆、赤峰绿豆、扎鲁特绿豆、呼伦贝尔芸豆、突泉绿豆 Tianshan Daming mung beans,Chifeng mung beans, Jalut mung beans, Hulunbuir kidney beans, Tuquan mung beans | 5 | 3 |

江苏 Jiangsu | 65 090 | 7 | 太仓毛板青蚕豆、启东绿皮蚕豆、海门大白皮蚕豆、启东青豌豆、启东洋扁豆、海门大红袍赤豆 Taicang Maoban green broad beans, Qidong green broad beans, Haimen large white broad beans, Qidong green pea, Qidong lima beans, Haimen Dahongpao adzuki beans | 6 | 2 |

黑龙江 Heilongjiang | 63 860 | 8 | 巴哈西伯绿豆、泰来绿豆、宝清红小豆、虎林红小豆、黑垦二九〇红小豆、萝北红小豆、明水黑豆、嫩江芸豆、拜泉芸豆、依安芸豆 Baha’sib mung beans, Tailai mung beans, Baoqing adzuki beans, Hulin adzuki beans, Heilongjiang adzuki beans, (Jiulin reclamation area Luobei adzuki beans, Mingshui black beans, Nenjiang kidney beans, Baiquan kidney beans, Yi’an kidney beans | 10 | 1 |

广西 Guangxi | 58 540 | 9 | — | 0 | — |

陕西 Shaanxi | 46 120 | 10 | 横山大明绿豆、甘泉红小豆 Hengshan Daming mung bean, Ganquan adzuki beans | 2 | 10 |

安徽 Anhui | 43 800 | 11 | 明光绿豆 Mingguang mung beans | 1 | 15 |

吉林 Jilin | 43 470 | 12 | 洮南绿豆、白城绿豆、通榆绿豆、通榆红小豆 Taonan mung beans, Baicheng mung beans, Tongyu mung beans, Tongyu adzuki beans | 4 | 5 |

江西 Jiangxi | 43 000 | 13 | — | 0 | — |

湖南 Hunan | 38 440 | 14 | — | 0 | — |

山西 Shanxi | 33 270 | 15 | 大同小明绿豆、兴县大明绿豆、岢岚红芸豆、五寨红芸豆 Datong Xiaoming mung beans, Xingxian Daming mung beans, Kelan red kidney beans, Wuzhai red kidney beans | 4 | 5 |

湖北 Hubei | 29 580 | 16 | — | 0 | — |

表1 各省食用豆种植面积及其初级农产品区域公用品牌数量

Table 1 Planting area and number of regional public brands of primary agricultural products of food legumes by province

省(自治区、直辖市) Province(autonomous region, municipality) | 种植面积 Planting area/hm2 | 面积排名 Area ranking | 品牌 Brand | 品牌数量 Brands quantity | 品牌数量排名 Ranking of brand quantity |

|---|---|---|---|---|---|

云南 Yunnan | 328 000 | 1 | 保山透心绿蚕豆、姚安豌豆 Baoshan Touxin green bread beans, Yao’an peas | 2 | 10 |

四川 Sichuan | 171 000 | 2 | 海棠大白芸豆 Haitang large white kidney beans | 1 | 15 |

贵州 Guizhou | 130 900 | 3 | 威宁芸豆、桐梓团芸豆、龙里豌豆尖 Weining kidney beans, Tongzi tuan kidney beans, Longli peatip | 3 | 8 |

重庆 Chongqing | 104 970 | 4 | — | 0 | — |

甘肃 Gansu | 94 630 | 5 | 会宁扁豆 Huining Lentils | 1 | 15 |

内蒙古 Inner Mongolia | 84 140 | 6 | 天山大明绿豆、赤峰绿豆、扎鲁特绿豆、呼伦贝尔芸豆、突泉绿豆 Tianshan Daming mung beans,Chifeng mung beans, Jalut mung beans, Hulunbuir kidney beans, Tuquan mung beans | 5 | 3 |

江苏 Jiangsu | 65 090 | 7 | 太仓毛板青蚕豆、启东绿皮蚕豆、海门大白皮蚕豆、启东青豌豆、启东洋扁豆、海门大红袍赤豆 Taicang Maoban green broad beans, Qidong green broad beans, Haimen large white broad beans, Qidong green pea, Qidong lima beans, Haimen Dahongpao adzuki beans | 6 | 2 |

黑龙江 Heilongjiang | 63 860 | 8 | 巴哈西伯绿豆、泰来绿豆、宝清红小豆、虎林红小豆、黑垦二九〇红小豆、萝北红小豆、明水黑豆、嫩江芸豆、拜泉芸豆、依安芸豆 Baha’sib mung beans, Tailai mung beans, Baoqing adzuki beans, Hulin adzuki beans, Heilongjiang adzuki beans, (Jiulin reclamation area Luobei adzuki beans, Mingshui black beans, Nenjiang kidney beans, Baiquan kidney beans, Yi’an kidney beans | 10 | 1 |

广西 Guangxi | 58 540 | 9 | — | 0 | — |

陕西 Shaanxi | 46 120 | 10 | 横山大明绿豆、甘泉红小豆 Hengshan Daming mung bean, Ganquan adzuki beans | 2 | 10 |

安徽 Anhui | 43 800 | 11 | 明光绿豆 Mingguang mung beans | 1 | 15 |

吉林 Jilin | 43 470 | 12 | 洮南绿豆、白城绿豆、通榆绿豆、通榆红小豆 Taonan mung beans, Baicheng mung beans, Tongyu mung beans, Tongyu adzuki beans | 4 | 5 |

江西 Jiangxi | 43 000 | 13 | — | 0 | — |

湖南 Hunan | 38 440 | 14 | — | 0 | — |

山西 Shanxi | 33 270 | 15 | 大同小明绿豆、兴县大明绿豆、岢岚红芸豆、五寨红芸豆 Datong Xiaoming mung beans, Xingxian Daming mung beans, Kelan red kidney beans, Wuzhai red kidney beans | 4 | 5 |

湖北 Hubei | 29 580 | 16 | — | 0 | — |

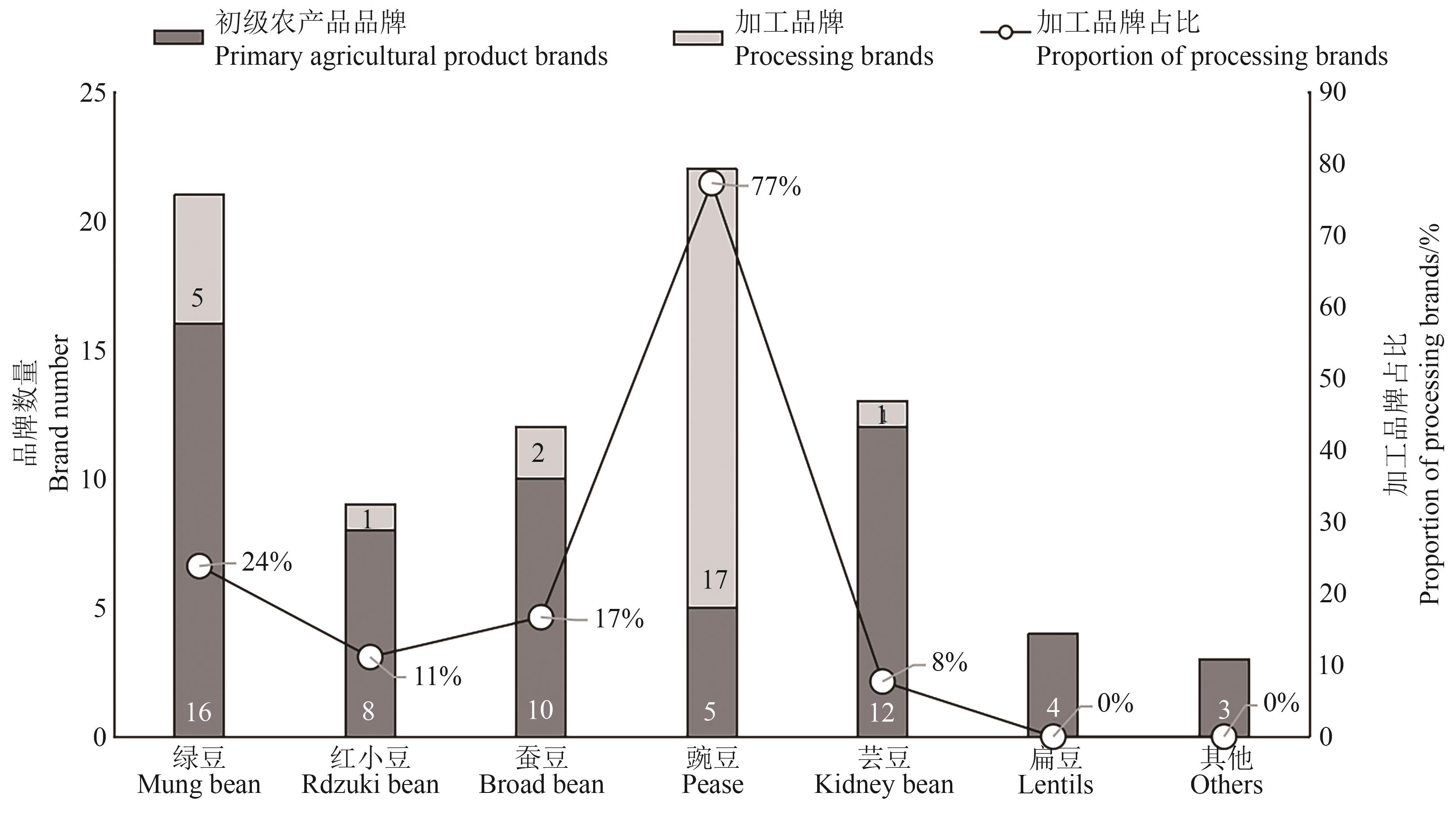

图2 我国不同品种食用豆区域公用品牌数量及类型数据来源:农业农村部和国家知识产权局。

Fig. 2 Number and types of regional public brands for different varieties of food legumes in ChinaData source:Ministry of Agriculture and Rural Affairs and China National Intellectual Property Administration.

省(自治区、直辖市) Province (autonomous region, municipality) | 种植面积 Planting area/hm2 | 面积排名 Area ranking | 品牌 Brand | 品牌数量 Brands quantity | 品牌数量排名 Ranking of brand quantity |

|---|---|---|---|---|---|

浙江 Zhejiang | 25 930 | 17 | — | 0 | — |

河北 Hebei | 25 300 | 18 | 崇礼蚕豆、阳原鹦哥绿豆、井陉红小豆 Chongli broad beans, Yangyuan Yingge mung beans, Jingxing adzuki beans | 3 | 8 |

河南 Henan | 22 210 | 19 | — | 0 | — |

新疆 Xinjiang | 16 330 | 20 | 木垒白豌豆、木垒鹰嘴豆、乌什鹰嘴豆、达坂城蚕豆、切尔克齐奶花芸豆 Mulei white pea, Mulei chickpea, Ushi chickpea, Dabancheng broad beans, Cherkeshi light speckled kidney beans | 5 | 3 |

青海 Qinghai | 14 420 | 21 | 湟中蚕豆、大通蚕豆、互助蚕豆、同仁豌豆Huangzhong broad beans,Datong broad beans, Huzhu broad beans, Tongren peas | 4 | 5 |

广东 Guangdong | 9 740 | 22 | — | 0 | — |

福建 Fujian | 7 820 | 23 | — | 0 | — |

辽宁 Liaoning | 5 760 | 24 | 建平红小豆、朝阳绿豆 Jianping adzuki beans, Chaoyang mung beans | 2 | 10 |

西藏 Xizang | 4 700 | 25 | — | 0 | — |

山东 Shandong | 3 630 | 26 | 泗水绿豆、白浮图芸豆(武城芸豆) Sishui mung beans, Baifutu kidney beans(Wucheng kidney bean) | 2 | 10 |

宁夏 Ningxia | 2 830 | 27 | 六盘山蚕豆 Liupanshan broad beans | 1 | 15 |

海南 Hainan | 2 510 | 28 | — | 0 | — |

北京 Beijing | 210 | 29 | — | 0 | — |

天津 Tianjin | 140 | 30 | — | 0 | — |

上海 Shanghai | 0 | 31 | 崇明白扁豆、彭镇青扁豆 Chongming white lentils, Pengzhen green lentils | 2 | 10 |

表1 各省食用豆种植面积及其初级农产品区域公用品牌数量 (续表Continued)

Table 1 Planting area and number of regional public brands of primary agricultural products of food legumes by province

省(自治区、直辖市) Province (autonomous region, municipality) | 种植面积 Planting area/hm2 | 面积排名 Area ranking | 品牌 Brand | 品牌数量 Brands quantity | 品牌数量排名 Ranking of brand quantity |

|---|---|---|---|---|---|

浙江 Zhejiang | 25 930 | 17 | — | 0 | — |

河北 Hebei | 25 300 | 18 | 崇礼蚕豆、阳原鹦哥绿豆、井陉红小豆 Chongli broad beans, Yangyuan Yingge mung beans, Jingxing adzuki beans | 3 | 8 |

河南 Henan | 22 210 | 19 | — | 0 | — |

新疆 Xinjiang | 16 330 | 20 | 木垒白豌豆、木垒鹰嘴豆、乌什鹰嘴豆、达坂城蚕豆、切尔克齐奶花芸豆 Mulei white pea, Mulei chickpea, Ushi chickpea, Dabancheng broad beans, Cherkeshi light speckled kidney beans | 5 | 3 |

青海 Qinghai | 14 420 | 21 | 湟中蚕豆、大通蚕豆、互助蚕豆、同仁豌豆Huangzhong broad beans,Datong broad beans, Huzhu broad beans, Tongren peas | 4 | 5 |

广东 Guangdong | 9 740 | 22 | — | 0 | — |

福建 Fujian | 7 820 | 23 | — | 0 | — |

辽宁 Liaoning | 5 760 | 24 | 建平红小豆、朝阳绿豆 Jianping adzuki beans, Chaoyang mung beans | 2 | 10 |

西藏 Xizang | 4 700 | 25 | — | 0 | — |

山东 Shandong | 3 630 | 26 | 泗水绿豆、白浮图芸豆(武城芸豆) Sishui mung beans, Baifutu kidney beans(Wucheng kidney bean) | 2 | 10 |

宁夏 Ningxia | 2 830 | 27 | 六盘山蚕豆 Liupanshan broad beans | 1 | 15 |

海南 Hainan | 2 510 | 28 | — | 0 | — |

北京 Beijing | 210 | 29 | — | 0 | — |

天津 Tianjin | 140 | 30 | — | 0 | — |

上海 Shanghai | 0 | 31 | 崇明白扁豆、彭镇青扁豆 Chongming white lentils, Pengzhen green lentils | 2 | 10 |

区域公用品牌 Regional public brand | 平均价格/ (元·kg-1) Average price/ (yuan·kg-1) | 平均溢价率 Average premium/% | 最低价格/ (元·kg-1) Floor price/ (yuan·kg-1) | 最高价格/ (元·kg-1) Ceiling price/ (yuan·kg-1) | 品牌溢价率区间 Brand premium range/% |

|---|---|---|---|---|---|

大同小明绿豆 Datong Xiaoming mung beans | 20.65 | 104.70 | 11.36 | 39.21 | 12.63~288.60 |

明光绿豆 Mingguang mung beans | 42.19 | 318.15 | 29.80 | 50.00 | 195.34~395.54 |

朝阳绿豆 Chaoyang mung beans | 20.13 | 99.46 | 12.95 | 26.91 | 28.34~166.67 |

横山大明绿豆 Hengshan Daming mung beans | 31.46 | 211.83 | 17.42 | 52.22 | 72.69~417.54 |

泰来绿豆 Tailai mung beans | 28.08 | 178.30 | 24.50 | 31.66 | 142.81~213.78 |

洮南绿豆 Taonan mung beans | 51.56 | 410.98 | 29.90 | 81.45 | 196.33~707.23 |

白城绿豆 Baicheng mung beans | 30.56 | 202.83 | 12.20 | 54.40 | 20.91~439.15 |

赤峰绿豆 Chifeng mung beans | 34.95 | 246.34 | 11.96 | 100.10 | 18.53~892.07 |

通榆绿豆 Tongyu mung beans | 40.21 | 298.50 | 35.67 | 44.75 | 253.52~343.51 |

阳原鹦哥绿豆 Yangyuan Yingge mung beans | 27.76 | 175.09 | 23.00 | 31.00 | 127.95~207.23 |

岢岚红芸豆 Kailan red kidney beans | 31.24 | 101.55 | 22.00 | 48.88 | 41.94~215.35 |

宝清红小豆 Baoqing adzuki beans | 47.19 | 288.39 | 17.79 | 164.00 | 46.42~1 249.79 |

建平红小豆 Jianping adzuki beans | 30.68 | 152.49 | 17.96 | 53.26 | 47.82~338.32 |

会宁扁豆 Huining lentils | 30.27 | 434.76 | 17.32 | 66.00 | 206.01~1 066.08 |

崇明白扁豆 Chongming white lentils | 37.34 | 559.67 | 11.16 | 93.50 | 97.17~1 551.94 |

海门大白皮蚕豆 Haimen big white skinned broad beans | 48.15 | 1 086.55 | 26.00 | 87.60 | 540.71~2 058.70 |

木垒鹰嘴豆 Mulei chickpeas | 25.88 | — | 11.16 | 74.40 | — |

表2 食用豆区域公用品牌溢价情况

Table 2 Regional public brand premium situation of food legumes

区域公用品牌 Regional public brand | 平均价格/ (元·kg-1) Average price/ (yuan·kg-1) | 平均溢价率 Average premium/% | 最低价格/ (元·kg-1) Floor price/ (yuan·kg-1) | 最高价格/ (元·kg-1) Ceiling price/ (yuan·kg-1) | 品牌溢价率区间 Brand premium range/% |

|---|---|---|---|---|---|

大同小明绿豆 Datong Xiaoming mung beans | 20.65 | 104.70 | 11.36 | 39.21 | 12.63~288.60 |

明光绿豆 Mingguang mung beans | 42.19 | 318.15 | 29.80 | 50.00 | 195.34~395.54 |

朝阳绿豆 Chaoyang mung beans | 20.13 | 99.46 | 12.95 | 26.91 | 28.34~166.67 |

横山大明绿豆 Hengshan Daming mung beans | 31.46 | 211.83 | 17.42 | 52.22 | 72.69~417.54 |

泰来绿豆 Tailai mung beans | 28.08 | 178.30 | 24.50 | 31.66 | 142.81~213.78 |

洮南绿豆 Taonan mung beans | 51.56 | 410.98 | 29.90 | 81.45 | 196.33~707.23 |

白城绿豆 Baicheng mung beans | 30.56 | 202.83 | 12.20 | 54.40 | 20.91~439.15 |

赤峰绿豆 Chifeng mung beans | 34.95 | 246.34 | 11.96 | 100.10 | 18.53~892.07 |

通榆绿豆 Tongyu mung beans | 40.21 | 298.50 | 35.67 | 44.75 | 253.52~343.51 |

阳原鹦哥绿豆 Yangyuan Yingge mung beans | 27.76 | 175.09 | 23.00 | 31.00 | 127.95~207.23 |

岢岚红芸豆 Kailan red kidney beans | 31.24 | 101.55 | 22.00 | 48.88 | 41.94~215.35 |

宝清红小豆 Baoqing adzuki beans | 47.19 | 288.39 | 17.79 | 164.00 | 46.42~1 249.79 |

建平红小豆 Jianping adzuki beans | 30.68 | 152.49 | 17.96 | 53.26 | 47.82~338.32 |

会宁扁豆 Huining lentils | 30.27 | 434.76 | 17.32 | 66.00 | 206.01~1 066.08 |

崇明白扁豆 Chongming white lentils | 37.34 | 559.67 | 11.16 | 93.50 | 97.17~1 551.94 |

海门大白皮蚕豆 Haimen big white skinned broad beans | 48.15 | 1 086.55 | 26.00 | 87.60 | 540.71~2 058.70 |

木垒鹰嘴豆 Mulei chickpeas | 25.88 | — | 11.16 | 74.40 | — |

省(自治区、直辖市) Province(autonomous region, municipality) | 种植集中度 Plant concentration ratio/% | 政策名称 Policy name | 指导意见 Guidance |

|---|---|---|---|

云南 Yunnan | 21.57 | 云南省种植业“三品一标”提升行动实施方案(2022—2025年) Implementation Plan for the “Three Products and One Standard” in Yunnan’s Planting Industry (2022—2025) | — |

四川 Sichuan | 11.25 | 四川省农业生产“三品一标”提升行动实施方案 Implementation Plan for the “Three Products and One Standard” of Agricultural Production in Sichuan | — |

贵州 Guizhou | 8.61 | 贵州省“十四五”种植业“三品一标”行动实施方案 Implementation Plan for the “Three Products and One Standard” of Planting Industry in Guizhou during the 14th Five Year Plan Period | — |

重庆 Chongqing | 6.90 | 重庆市农业品种品质品牌建设工程实施方案(2018—2022年)的通知 Notice on the Implementation Plan of Chongqing Agricultural Variety Quality Brand Construction Project (2018—2022) | 特色粮油重点发展高蛋白豆类等 Key development of characteristic grain and oil, high protein beans, etc |

甘肃 Gansu | 6.22 | 关于进一步加强两个“三品一标”建设打造“甘味”知名农产品品牌的实施方案(2019—2023年) Implementation Plan for Further Strengthening the Construction of Two “Three Products and One Standard” and Creating a Famous Agricultural Product Brand of “Sweet Taste” (2019—2023) | — |

内蒙古 Inner Mongolia | 5.53 | 农畜产品区域公用品牌建设三年行动方案(2021—2023年) Three Year Action Plan for Regional Public Brand Construction of Agricultural and Livestock Products (2021—2023) | — |

江苏 Jiangsu | 4.28 | 江苏省农业品牌精品培育计划(2023—2025年) Jiangsu Province Agricultural Brand Quality Cultivation Plan (2023—2025) | — |

黑龙江 Heilongjiang | 4.20 | 黑龙江省农业生产“三品一标”提升行动工作方案 Work Plan for Enhancing the “Three Products and One Standard” of Agricultural Production in Heilongjiang Province | — |

广西 Guangxi | 3.85 | 广西农产品“三品一标”四大行动实施方案的通知(桂农厅办发〔2023〕5号) Notice on the Implementation Plan of the Four Major Actions of Guangxi Agricultural Products’ Three Products and One Standard’ (Guinong Department Office 〔2023〕5) | 建设鱼峰区豇豆等7个国家现代农业全产业链示范基地 Construct 7 national modern agriculture full industry chain standardization demonstration bases, including cowpea in Yufeng District |

| 陕西Shaanxi | 3.03 | 陕西农产品“三品一标”四大行动实施方案的通知 (陕农办发〔2021〕111号) Notice on the Implementation Plan of the Four Major Actions of Shaanxi Agricultural Products’ Three Products and One Standard’ (Shannong Department Office 〔2021〕111) | — |

表3 食用豆主产省农产品品牌培育核心政策汇总

Table 3 Summary of core policies for brand cultivation in major producing provinces of food legumes

省(自治区、直辖市) Province(autonomous region, municipality) | 种植集中度 Plant concentration ratio/% | 政策名称 Policy name | 指导意见 Guidance |

|---|---|---|---|

云南 Yunnan | 21.57 | 云南省种植业“三品一标”提升行动实施方案(2022—2025年) Implementation Plan for the “Three Products and One Standard” in Yunnan’s Planting Industry (2022—2025) | — |

四川 Sichuan | 11.25 | 四川省农业生产“三品一标”提升行动实施方案 Implementation Plan for the “Three Products and One Standard” of Agricultural Production in Sichuan | — |

贵州 Guizhou | 8.61 | 贵州省“十四五”种植业“三品一标”行动实施方案 Implementation Plan for the “Three Products and One Standard” of Planting Industry in Guizhou during the 14th Five Year Plan Period | — |

重庆 Chongqing | 6.90 | 重庆市农业品种品质品牌建设工程实施方案(2018—2022年)的通知 Notice on the Implementation Plan of Chongqing Agricultural Variety Quality Brand Construction Project (2018—2022) | 特色粮油重点发展高蛋白豆类等 Key development of characteristic grain and oil, high protein beans, etc |

甘肃 Gansu | 6.22 | 关于进一步加强两个“三品一标”建设打造“甘味”知名农产品品牌的实施方案(2019—2023年) Implementation Plan for Further Strengthening the Construction of Two “Three Products and One Standard” and Creating a Famous Agricultural Product Brand of “Sweet Taste” (2019—2023) | — |

内蒙古 Inner Mongolia | 5.53 | 农畜产品区域公用品牌建设三年行动方案(2021—2023年) Three Year Action Plan for Regional Public Brand Construction of Agricultural and Livestock Products (2021—2023) | — |

江苏 Jiangsu | 4.28 | 江苏省农业品牌精品培育计划(2023—2025年) Jiangsu Province Agricultural Brand Quality Cultivation Plan (2023—2025) | — |

黑龙江 Heilongjiang | 4.20 | 黑龙江省农业生产“三品一标”提升行动工作方案 Work Plan for Enhancing the “Three Products and One Standard” of Agricultural Production in Heilongjiang Province | — |

广西 Guangxi | 3.85 | 广西农产品“三品一标”四大行动实施方案的通知(桂农厅办发〔2023〕5号) Notice on the Implementation Plan of the Four Major Actions of Guangxi Agricultural Products’ Three Products and One Standard’ (Guinong Department Office 〔2023〕5) | 建设鱼峰区豇豆等7个国家现代农业全产业链示范基地 Construct 7 national modern agriculture full industry chain standardization demonstration bases, including cowpea in Yufeng District |

| 陕西Shaanxi | 3.03 | 陕西农产品“三品一标”四大行动实施方案的通知 (陕农办发〔2021〕111号) Notice on the Implementation Plan of the Four Major Actions of Shaanxi Agricultural Products’ Three Products and One Standard’ (Shannong Department Office 〔2021〕111) | — |

豆种 Species | 品牌数量排名前3的省份 Top 3 provinces by brands quantity | 占比 Proportion/% |

|---|---|---|

绿豆 Mung beans | 内蒙古、黑龙江、吉林、山西(后3省并列第2) Inner Mongolia, Heilongjiang, Jilin and Shanxi (the latter three provinces are tied for second place) | 62.50 |

蚕豆 Broad beans | 青海、江苏、四川 Qinghai, Jiangsu, Sichuan | 80.00 |

红小豆 Adzuki beans | 黑龙江、河北、陕西、辽宁、吉林、江苏(后5省并列第2) Heilongjiang, Hebei, Shaanxi, Liaoning, Jilin and Jiangsu (tied for second place are the last five provinces) | 100.00 |

芸豆 Kidney beans | 黑龙江、贵州、山西 Heilongjiang, Guizhou, Shanxi | 66.67 |

豌豆 Pease | 新疆、贵州、云南、青海、江苏(并列第1) Xinjiang, Guizhou, Yunnan, Qinghai, Jiangsu (tied for first place) | 100.00 |

表4 食用豆主要豆种区域公用品牌分布及占比

Table 4 Proportion of regional public brands in main species of food legumes

豆种 Species | 品牌数量排名前3的省份 Top 3 provinces by brands quantity | 占比 Proportion/% |

|---|---|---|

绿豆 Mung beans | 内蒙古、黑龙江、吉林、山西(后3省并列第2) Inner Mongolia, Heilongjiang, Jilin and Shanxi (the latter three provinces are tied for second place) | 62.50 |

蚕豆 Broad beans | 青海、江苏、四川 Qinghai, Jiangsu, Sichuan | 80.00 |

红小豆 Adzuki beans | 黑龙江、河北、陕西、辽宁、吉林、江苏(后5省并列第2) Heilongjiang, Hebei, Shaanxi, Liaoning, Jilin and Jiangsu (tied for second place are the last five provinces) | 100.00 |

芸豆 Kidney beans | 黑龙江、贵州、山西 Heilongjiang, Guizhou, Shanxi | 66.67 |

豌豆 Pease | 新疆、贵州、云南、青海、江苏(并列第1) Xinjiang, Guizhou, Yunnan, Qinghai, Jiangsu (tied for first place) | 100.00 |

| 1 | 董银果,钱薇雯.农产品区域公用品牌建设中的 “搭便车” 问题——基于数字化追溯、透明和保证体系的治理研究[J].中国农村观察,2022(6):142-162. |

| DONG Y G, QIAN W W. The free-rider problem in the construction of region public brands of agricultural products:an analysis based on governance study of digital traceability,transparency and assurances systems [J]. China Rural. Surv., 2022(6):142-162. | |

| 2 | 张蕙杰,麻吉亮,岳慧丽,等.中国食用豆产业与发展[M].北京:中国农业出版社,2021: 9-23. |

| 3 | 郭永田.中国食用豆产业的经济分析[D].武汉:华中农业大学,2014. |

| GUO Y T.The economic analysis of edible bean industry in China [D]. Wuhan: Huazhong Agricultural University, 2014. | |

| 4 | 钱静斐,张蕙杰.中国食用豆贸易演变特征及现状分析[J].中国食物与营养,2021,27(2):20-25. |

| QIAN J F, ZHANG H J. Analysis on the characteristics and current situation of China’s edible beans trade [J]. Food Nutr. China, 2021, 27(2):20-25. | |

| 5 | 米韵熹.小绿豆 大文章[EB/OL]. (2015-04-20) [2024-12-08]. . |

| 6 | MA J L, KHAN N, GONG J, et al.. From an introduced pulse variety to the principal local agricultural industry: a case study of red kidney beans in Kelan, China [J/OL]. Agronomy, 2022, 12(7):1717 [2024-12-08]. . |

| 7 | 王滨.“红豆” 生北国——走进“中国红小豆之乡” 宝清[J].黑龙江粮食,2015(2):44-46. |

| 8 | 张蕙杰,徐东旭,张鸾. 小杂粮闯出新天地[EB/OL].(2024-12-04)[2024-12-08]. . |

| 9 | 王小璟,万怡,邱欢.我国区域公用品牌基本状况分析[J].宏观质量研究,2023,11(2):12-23. |

| WANG X J, WAN Y, QIU H. Analysis on the basic situation of regional public brands in China [J]. J. Macro Qual. Res., 2023,11(2):12-23. | |

| 10 | 冯晓,史兴民,赵振斌.地理标志农产品对农户生计脆弱性和福祉的影响——以黄河流域旱塬区为例[J].地理研究,2024,43(10):2702-2720. |

| FENG X, SHI X M, ZHAO Z B. Impact of geographical indication agricultural products on farmers’ livelihood vulnerability and well-being:a case study of the dryland plateau of the Yellow River Basin [J]. Geogr. Res., 2024, 43(10): 2702-2720. | |

| 11 | 程虹,黄锋,聂枭镒.区域公用品牌价值的衡量方法——基于 “潜江龙虾” 案例的研究[J].宏观质量研究,2022,10(3):1-21. |

| CHENG H, HUANG F, NIE X Y. A measurement method for the regional public brand value:a case study based on Qianjiang crayfish [J]. J. Macro Qual. Res., 2022,10(3):1-21. | |

| 12 | 乔怡迪,吴祎炀,卞佳玲.区域公用品牌价值提升路径研究——无形公共资产视角[J].宏观质量研究,2023,11(5):16-32. |

| QIAO Y D, WU Y Y, BIAN J L. Research on the path of regional public brand value growth——based on the perspective of intangible public assets [J]. J. Macro-quality Res., 2023,11(5):16-32. | |

| 13 | 中国农业品牌研究中心.中国地理标志农产品品牌声誉前 100位[EB/OL]. (2022-06-22)[2024-12-08]. . |

| 14 | 中国农业品牌研究中心.2022中国地理标志农产品(粮油)品牌声誉前 100位[EB/OL]. (2023-08-11)[2024-12-08]. . |

| 15 | 中国农业品牌研究中心.中国地理标志农产品品牌声誉前 100位[EB/OL]. (2024-05-29)[2024-12-8]. . |

| 16 | 品牌观察.国家地理标志绿豆品牌价值排行榜[EB/OL]. (2023-09-04)[2024-12-08]. . |

| 17 | 李丹,周宏,周力.品牌溢价与农产品质量安全——来自江苏水稻种植的例证[J].财经研究,2021,47(2):34-48. |

| LI D, ZHOU H, ZHOU L. Brand premium and the quality and safety of agricultural products:examples from rice planting in Jiangsu province [J]. J. Finance Econ., 2021,47(2):34-48. | |

| 18 | 张艳,黄炎忠. 地理标志品牌参与对农产品质量安全的影响研究[J].华中农业大学学报(社会科学版), 2022(5):123-135. |

| ZHANG Y, HUANG Y Z. Research on the influence of geographical indication brand participation on the quality and safety of agricultural products [J]. J. Huazhong Agric. Univ.(Soc. Sci.), 2022(5):123-135. | |

| 19 | 周涌.关于品牌溢价率测算研究——以家用汽车为例[J].价格理论与实践,2018(8):159-162. |

| ZHOU Y. Study on Chinese manufacturing and brand premium rate:based on the measurement of relative premium rate of domestic automobile [J]. Price Theory Pract., 2018(8):159-162. | |

| 20 | 魔镜市场情报. 2023药食同源保健品滋补品行业分析报告[EB/OL]. (2023-08-17)[2024-12-08].https:/ . |

| 21 | 澎湃新闻.吃白芸豆产品减肥,又是智商税?[EB/OL]. (2023-04-23) [2024-12-08]. . |

| 22 | 陈沐.从绿肥到良谷:绿豆功能变迁研究[J].农业考古,2024(4):158-164. |

| CHEN M. From green fertilizer to good valley:the functional evolution of mung bean [J]. Agric. Archaeol., 2024(4):158-164. | |

| 23 | 李新贵.浅淡红小豆的经济药用价值与加工综合利用[J].现代化农业,2005(7):19. |

| 24 | 郑虹君,朱叙丞,李耀基,等.白芸豆功能成分、生物活性及其产品开发研究进展[J].中国粮油学报,2022,37(12):277-285. |

| ZHENG H J, ZHU X C, LI Y J, et al.. A review of functional components,bioactivities and product development of white kidney bean [J]. J. Chin. Cereals Oils Assoc., 2022,37(12):277-285. | |

| 25 | 张鸾,王恒,王益慧,等. 新西兰蜂蜜突破出口贸易增长瓶颈的规律及经验启示[J].中国食物与营养,2025,31(1): 63-71. |

| ZHANG L, WANG H, WANG Y H, et al.. Law and experience of New Zealand manuka honey in overcoming export trade bottlenecks [J]. Food Nutr. China, 2025,31(1): 63-71. |

| [1] | 牛凯,何鹏,李晓*. 我国宏观经济指标对农产品生产价格波动影响的实证研究[J]. , 2013, 15(4): 88-96. |

| 阅读次数 | ||||||

|

全文 |

|

|||||

|

摘要 |

|

|||||

京公网安备11010802021197号

京公网安备11010802021197号